Investing for dummies was a keyword I searched for when I wanted to learn the ropes of finance and turn my financial confusion into clarity. Back then, resources were scarce, and while I’m no pro now, I’m proud of how far I’ve come.

Did you know that if you start investing $200 a month that yields at age 25, you could have over $500,000 by the time you retire? That’s what investing can do. It’s not just for the wealthy or the finance geeks. It’s for everyone who wants to grow their money and secure their future.

I know investing can be intimidating. Everyone makes mistakes, including me. I once invested in a forex project that cost me over $500. Yes, you read that right. But I learned from it, and you can too.

The goal of this guide is simple: to make investing easy and understandable for beginners. We’ll provide a fast track to wealth. Whether you’re new to investing or just looking to sharpen your skills, this guide is for you. Let’s dive into the world of “investing for dummies” and start your journey to financial success.

1. Setting the Foundation for Investing for Dummies

1.1 What is Investing?

Investing is the act of putting your money into assets like stocks, bonds, or real estate to make a profit. Unlike saving, where you simply store your money, investing involves making your money grow over time. This growth happens through interest, dividends, or the increase in the value of the assets you own.

Definition and Key Concepts

To understand “investing for dummies,” let’s break down some key concepts:

- Assets: These are things you can invest in, like stocks, bonds, or real estate.

- Return on Investment (ROI): This is the profit you make from your investments. It’s usually shown as a percentage of the amount you invested.

- Risk: This is the possibility that your investment will lose money. Different investments have different levels of risk.

- Diversification: This means spreading your money across different investments to reduce risk. It’s like not putting all your eggs in one basket.

Difference Between Saving and Investing

Saving and investing are both important, but they are not the same.

- Saving is setting aside money for future use without risk. You might keep this money in a savings account where it earns a little interest.

- Investing, on the other hand, involves taking some risk to potentially earn a lot more money. When you invest, you buy assets that can increase in value over time.

1.2 Why Invest?

Importance of Investing for Financial Growth

Think about this: inflation reduces the value of money over time. If you only save, your money might not keep up with rising prices. Investing helps you stay ahead of inflation and increase your purchasing power. It’s like planting a tree. The sooner you start, the bigger it grows. For “investing for dummies,” the goal is to get your money to grow, providing financial security and freedom.

Perspective on Investment Returns vs. Savings

Looking at history, investments have outperformed savings by a wide margin. Let’s take a simple example. If you had put $1,000 in a savings account 30 years ago with an average annual interest rate of 2%, you would have around $1,800 today. Not bad, but not great either.

Now, imagine you invested that same $1,000 in the stock market 30 years ago. With an average annual return of about 7%, you would have over $7,600 today. That’s a huge difference. This shows how investing can significantly increase your wealth over time.

3.4 Real Estate

In exploring “investing for dummies” real estate is another popular investment option. It involves buying property to generate income or appreciation.

Basics of Real Estate Investing

Real estate investing means purchasing properties like houses, apartments, or commercial buildings. You can rent them out to earn rental income or sell them later at a higher price. For example, buying a house, fixing it up, and renting it out is a form of real estate investing. There are different ways to invest in real estate, such as:

- Residential Properties: Buying houses or apartments to rent to tenants.

- Commercial Properties: Investing in office buildings, retail spaces, or warehouses.

- REITs (Real Estate Investment Trusts): Buying shares in a company that owns and manages real estate. This way, you invest in real estate without owning physical property.

Pros and Cons of Real Estate Investments

| Pros | Cons |

|---|---|

| Steady Income: Rental properties can provide a steady income stream. | High Initial Costs: Buying a property requires a significant amount of money upfront. |

| Appreciation: Real estate can increase in value over time, offering potential profits when sold. | Maintenance and Management: Properties need regular maintenance and management, which can be time-consuming and costly. |

| Tax Benefits: Real estate investors can enjoy tax deductions on mortgage interest, property taxes, and other expenses. | Market Fluctuations: Property values can go down, especially in economic downturns. |

3.5 Alternative Investments

Besides traditional investments, investing for dummies includes exploring alternative options like cryptocurrency and commodities. These can diversify your portfolio but come with unique risks and rewards.

Cryptocurrency, Commodities, and Other Alternatives

- Cryptocurrency: Digital or virtual currency that uses cryptography for security. Bitcoin and Ethereum are popular examples. Cryptocurrencies can be highly volatile but offer significant profit potential.

- Commodities: Physical goods like gold, silver, oil, and agricultural products. Investors can buy physical commodities or invest in commodity-focused funds. Commodities can hedge against inflation.

- Other Alternatives: Includes collectibles like art, wine, or rare coins. These investments can be fun but require specialized knowledge.

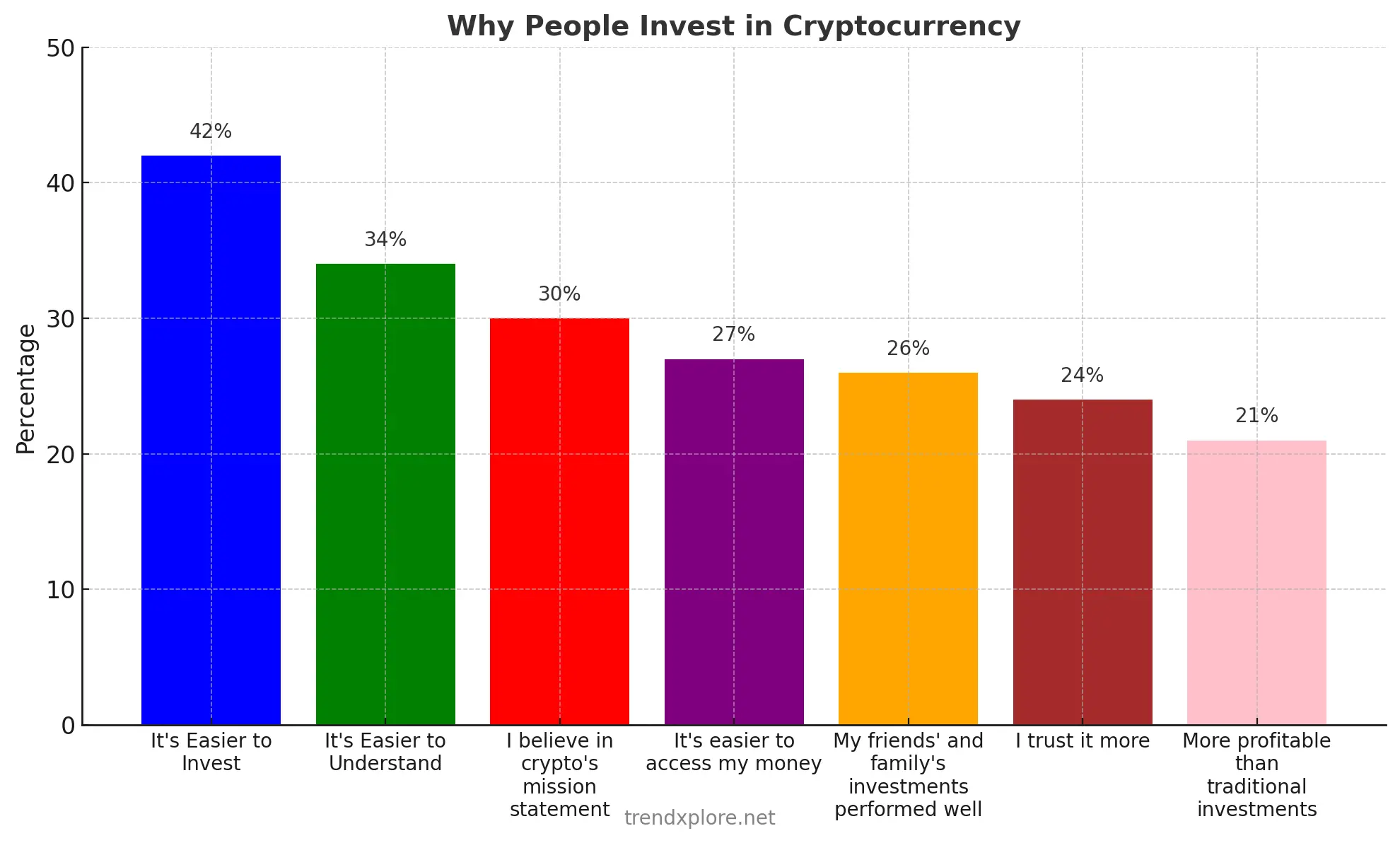

According to Forbes, 42% of people invest in cryptocurrency because they find it easier to manage compared to traditional investments.

Risks and Rewards of Alternative Investments

| Pros | Cons |

|---|---|

| High Potential Returns: Cryptocurrencies and some commodities can offer substantial returns. For example, Bitcoin’s value has skyrocketed in recent years. | Volatility: Cryptocurrencies can be extremely volatile, with prices swinging wildly. |

| Diversification: Alternative investments can diversify your portfolio, reducing overall risk. | Lack of Regulation: Some alternative investments lack regulatory oversight, increasing the risk of fraud. |

| Inflation Hedge: Commodities like gold can protect against inflation, preserving your investment’s value. | Complexity: Understanding the market for art, wine, or other collectibles requires specialized knowledge and expertise. |

4. Investing for Dummies: Strategies To Consider

When it comes to investing for dummies, understanding basic strategies can help you make smart decisions. Two key strategies are diversification and dollar-cost averaging. These strategies can help you manage risk and grow your investments over time.

4.1 Diversification

Diversification means spreading your investments across different assets to reduce risk. Think of it as not putting all your eggs in one basket. If one investment performs poorly, others might do well, balancing your overall risk.

Importance and Methods of Diversifying Your Portfolio

Diversification is important because it helps protect your portfolio from big losses. For example, if you invest only in tech stocks and the tech market crashes, your entire portfolio suffers. But if you also invest in bonds, real estate, and commodities, a drop in tech stocks won’t hurt as much.

Methods to diversify your portfolio include:

- Invest in Different Asset Classes: Include stocks, bonds, real estate, and commodities in your portfolio.

- Spread Investments Across Sectors: Within stocks, invest in various sectors like technology, healthcare, and finance.

- Use Mutual Funds and ETFs: These funds already include a mix of assets, making diversification easier.

- Geographic Diversification: Invest in both domestic and international markets to spread risk across different economies.

4.2 Dollar-Cost Averaging

Explanation and benefits of dollar-cost averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market conditions. For example, you invest $100 every month in a particular stock or mutual fund. This strategy helps reduce the impact of market volatility on your investments.

Benefits of dollar-cost averaging include:

- Reduces Emotional Investing: By investing regularly, you avoid the temptation to time the market, which can lead to poor decisions.

- Mitigates Risk: Regular investments mean you buy more shares when prices are low and fewer shares when prices are high, potentially lowering your average cost per share.

- Promotes Discipline: It encourages a consistent investment habit, which can be crucial for long-term growth.

How to implement it in your investment strategy

- Choose Your Investments: Select the stocks, mutual funds, or ETFs you want to invest in regularly.

- Set a Fixed Amount: Decide on a fixed amount you can comfortably invest each month. Even small amounts can grow over time.

- Stick to a Schedule: Invest the fixed amount at regular intervals, such as monthly or quarterly. Set up automatic transfers to make this easier.

- Monitor and Adjust: Keep an eye on your investments and adjust your strategy if needed. However, avoid making changes based on short-term market fluctuations.

4.3 Value Investing vs. Growth Investing

Differences Between Value and Growth Investing

- Value Investing: This strategy focuses on buying undervalued stocks. These are stocks that the market has overlooked or undervalued. Value investors believe these stocks will rise in price once the market realizes their true worth. For example, if a company’s stock is trading at $50, but its true value is $70, a value investor would buy it, expecting the price to eventually increase.

- Growth Investing: This strategy involves buying stocks of companies expected to grow at an above-average rate. Growth investors look for companies with strong future potential, even if their current price is high. For instance, investing in a tech startup that is expanding rapidly could be considered growth investing.

How to decide which strategy suits you

To choose between value and growth investing, consider your risk tolerance, investment goals, and time horizon:

- Risk Tolerance: Value investing is often seen as less risky because it focuses on undervalued stocks, which might have less room to fall. Growth investing can be riskier since it involves stocks with high growth potential but also higher volatility.

- Investment Goals: If you’re looking for steady returns and less volatility, value investing might be better. If you aim for higher returns and are willing to accept more risk, growth investing could suit you.

- Time Horizon: Value investing can take time to pay off, as it waits for the market to recognize a stock’s true value. Growth investing might offer quicker returns but comes with more ups and downs. Choose based on how long you’re willing to wait for your investments to grow.

4.4 Passive vs. Active Investing

Definition and Comparison of Passive and Active Investing

- Passive Investing: This strategy involves investing in a portfolio that mirrors a market index, like the S&P 500. The goal is to match the market’s performance. Index funds and ETFs are common tools for passive investing. For example, buying shares in an S&P 500 ETF means you’re investing in all the companies in the S&P 500.

- Active Investing: This strategy involves picking stocks or other assets to try to outperform the market. Active investors use research, analysis, and their judgment to make investment decisions. For example, a fund manager selecting specific stocks to buy or sell is practicing active investing.

Pros and Cons of Each Approach

| Passive Investing | |

|---|---|

| Pros | Cons |

| – Lower fees since it involves less buying and selling. | – It doesn’t try to beat the market. |

| – Simpler and less time-consuming. | – You get the market’s returns, no more, no less. |

| – Historically, passive investing has matched or outperformed many actively managed funds. | – Less flexibility in responding to market changes. |

| Active Investing | |

| – Potential to outperform the market. | – Higher fees due to more frequent trading. |

| – More control over investment choices. | – Requires more time, effort, and expertise. |

| – Ability to react to market trends and changes. | – Higher risk if the investor or fund manager makes poor decisions. |

5. Investing for Dummies: Tools and Resources

Having the right tools and resources is crucial. These tools make it easier to manage your investments and stay informed.

5.1 Investment Platforms and Brokers

Overview of Popular Investment Platforms

Investment platforms are online services that allow you to buy and sell investments. They offer various tools and resources to help you manage your portfolio. Here are some popular investment platforms:

- Robinhood: Known for commission-free trades and a user-friendly mobile app, Robinhood is great for beginners. It offers stocks, ETFs, options, and cryptocurrencies.

- E*TRADE: This platform provides a wide range of investment options, including stocks, bonds, ETFs, mutual funds, and futures. E*TRADE also offers robust research tools and educational resources.

- Vanguard: Vanguard is well-known for its low-cost index funds and ETFs. It’s a solid choice for long-term investors focused on retirement savings.

- Fidelity: Offering a variety of investment options and excellent customer service, Fidelity is suitable for both beginners and experienced investors. It provides extensive research tools and educational content.

- Charles Schwab: Schwab offers a broad range of investment options with low fees. It’s known for its comprehensive research tools and excellent customer support.

Criteria for Choosing a Broker

Choosing the right broker is essential for successful investing. Here are some criteria to consider:

- Fees and Commissions: Look for brokers that offer low fees and commissions. High fees can eat into your returns over time. Platforms like Robinhood and Vanguard are known for low costs.

- Investment Options: Ensure the broker offers the types of investments you’re interested in. For example, if you want to invest in mutual funds, make sure the broker has a good selection.

- User Experience: The platform should be easy to use, especially for beginners. A clean, intuitive interface makes managing your investments less stressful.

- Research and Tools: Good research tools and educational resources are valuable. They help you make informed decisions. Platforms like E*TRADE and Fidelity excel in this area.

- Customer Service: Reliable customer support is crucial. If you encounter issues or have questions, responsive customer service can be a lifesaver. Charles Schwab and Fidelity are known for their excellent support.

- Security: Your broker should have strong security measures to protect your personal and financial information. Look for brokers with a good reputation for security.

- Account Types: Ensure the broker offers the account types you need, such as individual brokerage accounts, retirement accounts (IRA), or college savings accounts (529 plans).

5.2 Financial Advisors and Robo-Advisors

Role of Financial Advisors

Financial advisors are professionals who help you manage your investments and plan for your financial goals. They offer personalized advice based on your financial situation, risk tolerance, and investment goals. Here are some key roles they play:

- Personalized Advice: Financial advisors provide tailored recommendations. For example, they might suggest a mix of stocks, bonds, and real estate based on your age, income, and goals.

- Financial Planning: They help you create a comprehensive financial plan, including retirement planning, tax strategies, and estate planning.

- Portfolio Management: Advisors manage your investment portfolio, making adjustments as needed to keep it aligned with your goals.

- Education: They educate you about different investment options and strategies, helping you make informed decisions.

Benefits of Using Robo-advisors for Beginners

Robo-advisors are automated platforms that provide investment management services based on algorithms. They are a great option for beginners. Here’s why:

- Low Cost: Robo-advisors typically charge lower fees than traditional financial advisors. This makes them accessible for investors with smaller portfolios.

- Ease of Use: They offer a user-friendly experience. You can set up an account and start investing with just a few clicks. Platforms like Betterment and Wealthfront are popular choices.

- Automated Management: Robo-advisors handle everything from portfolio allocation to rebalancing. For example, if your portfolio drifts away from your target allocation, the robo-advisor automatically adjusts it.

- Goal-Based Investing: They help you set and achieve financial goals, such as saving for retirement or buying a home. You input your goals, and the robo-advisor creates a plan to help you reach them.

5.3 Educational Resources

Books, Blogs, Podcasts, and Courses for Learning about Investing

Educating yourself is a crucial part of investing for dummies. Here are some valuable resources:

- Books: Some classics include “The Intelligent Investor” by Benjamin Graham and “A Random Walk Down Wall Street” by Burton Malkiel. These books offer timeless investing principles and insights.

- Blogs: Websites like Investopedia and The Motley Fool provide articles and guides on various investment topics. They are great for staying informed about the latest trends and strategies.

- Podcasts: Listening to investment podcasts can be a convenient way to learn. “The Dave Ramsey Show” and “BiggerPockets Money Podcast” are popular choices that cover a wide range of financial topics.

- Courses: Online platforms like Coursera and Udemy offer courses on investing. For example, you can take a course on stock market basics or personal finance management.

How to stay Updated With the Latest Investment News

Staying informed is key to successful investing. Here are some ways to keep up with the latest investment news:

- Financial News Websites: Websites like Bloomberg, CNBC, and MarketWatch provide up-to-date news and analysis on financial markets.

- Newsletters: Subscribe to investment newsletters like Morning Brew or The Motley Fool’s Stock Advisor. They deliver the latest news and insights directly to your inbox.

- Social Media: Follow financial experts and institutions on platforms like Twitter and LinkedIn. They often share timely news and analysis.

- Apps: Use financial news apps like Yahoo Finance or Google Finance to get real-time updates and alerts on market movements.

6. Managing and Monitoring Your Investments for Dummies

Once you’ve started investing, managing and monitoring your investments is crucial. This ensures your portfolio stays aligned with your goals and adapts to market changes. Let’s explore how to track your portfolio and the importance of regular reviews.

6.1 Tracking Your Portfolio

Tools and Apps for Portfolio Tracking

Tracking your portfolio helps you keep an eye on how your investments are performing. Several tools and apps make this process simple and efficient. Here are some popular options:

- Personal Capital: This app offers comprehensive portfolio tracking along with budgeting tools. It lets you link all your accounts to get a complete picture of your finances. Personal Capital also provides insights into your investment performance and fees.

- Mint: Known for budgeting, Mint also offers portfolio tracking features. It aggregates all your financial accounts, giving you an overview of your investments and their performance.

- Yahoo Finance: This app allows you to track stocks, mutual funds, and ETFs. You can create a custom watchlist to monitor specific investments and get real-time updates.

- Morningstar: Morningstar offers detailed investment research and tracking tools. You can use their portfolio tracker to analyze your holdings, see performance metrics, and get recommendations.

- Google Sheets: For a customizable option, you can create a portfolio tracker in Google Sheets. Use financial functions and data import tools to keep your investment information up to date.

Importance of Regular Portfolio Reviews

Regularly reviewing your portfolio is essential for maintaining a healthy investment strategy. Here’s why:

- Stay Aligned with Goals: Over time, your financial goals might change. Regular reviews help ensure your portfolio still aligns with your objectives, such as saving for retirement or buying a home.

- Adjust for Risk: As you get closer to your goals, your risk tolerance might decrease. Regular reviews allow you to adjust your asset allocation to reduce risk. For example, shifting from stocks to bonds as you near retirement.

- Rebalance Your Portfolio: Market fluctuations can cause your asset allocation to drift. Rebalancing involves adjusting your investments to return to your target allocation. For instance, if stocks have performed well and now make up a larger portion of your portfolio, you might sell some stocks and buy bonds to rebalance.

- Identify Underperforming Investments: Regular reviews help you spot investments that are not meeting expectations. This allows you to make informed decisions about selling or holding these assets.

- Stay Informed: The investment landscape is constantly changing. Regular reviews keep you updated on market trends, new investment opportunities, and potential risks.

For example, let’s say you have a portfolio consisting of 60% stocks and 40% bonds. After a year, due to market performance, your portfolio might shift to 70% stocks and 30% bonds. During your regular review, you notice this change and decide to rebalance by selling some stocks and buying bonds to return to your original allocation.

6.2 Rebalancing Your Portfolio

What is Rebalancing and Why it’s Important

When it comes to investing for dummies, rebalancing your portfolio involves adjusting the proportions of different assets to maintain your desired asset allocation. It is key if we must demystify “investing for dummies”. For example, if you aim for a portfolio of 60% stocks and 40% bonds, market changes might shift this balance over time. If stocks perform well, your portfolio might become 70% stocks and 30% bonds.

Rebalancing is important because:

- Maintains Risk Levels: Your original asset allocation reflects your risk tolerance. Without rebalancing, you might take on more risk than you’re comfortable with.

- Promotes Discipline: Rebalancing enforces a disciplined investment approach. You sell high-performing assets and buy underperforming ones, potentially buying low and selling high.

- Aligns with Goals: As your financial goals change, rebalancing ensures your portfolio remains aligned with these goals. For example, shifting to more conservative investments as you approach retirement.

How Often to Rebalance Your Portfolio

The frequency of rebalancing depends on several factors, including your investment strategy and market conditions. Here are some common approaches:

- Annual Rebalancing: Review and rebalance your portfolio once a year. This is simple and helps you stay aligned with your goals without frequent adjustments.

- Semi-Annual or Quarterly Rebalancing: More frequent reviews can help you react to market changes sooner. This approach might be suitable if your portfolio is highly volatile.

- Threshold-Based Rebalancing: Rebalance when your asset allocation deviates by a certain percentage from your target. For example, if your allocation shifts by more than 5%, you rebalance. This method combines flexibility with discipline.

For example, if your target allocation is 60% stocks and 40% bonds, and the stock market performs well, increasing your stocks to 65%, you would sell some stocks and buy bonds to return to your 60/40 target.

6.3 Understanding Taxes on Investments

Overview of Taxes on Different Types of Investments

Different investments are subject to different tax treatments. Understanding these can help you minimize your tax burden. Here’s a basic overview:

- Stocks: Profits from selling stocks are subject to capital gains tax. If you hold a stock for more than a year, you pay long-term capital gains tax, which is lower than short-term capital gains tax for assets held less than a year. Dividends from stocks are also taxable, with qualified dividends taxed at a lower rate.

- Bonds: Interest income from bonds is usually taxed as ordinary income. However, municipal bonds are often exempt from federal taxes and sometimes state and local taxes.

- Mutual Funds and ETFs: These funds distribute capital gains and dividends to investors, which are taxable. ETFs generally have lower capital gains distributions due to their structure, making them more tax-efficient.

- Real Estate: Rental income is taxable as ordinary income. When you sell a property, you pay capital gains tax on the profit. However, you can defer taxes through a 1031 exchange by reinvesting the proceeds in a similar property.

Tax-Efficient Investment Strategies

To minimize taxes, consider these strategies:

- Tax-Advantaged Accounts: Use accounts like IRAs, 401(k)s, and Roth IRAs. These accounts offer tax benefits, such as tax-deferred growth or tax-free withdrawals.

- Tax-Loss Harvesting: Offset capital gains by selling investments that have lost value. For example, if you have a stock that has decreased in value, you can sell it to offset gains from other investments.

- Hold Investments Longer: Benefit from lower long-term capital gains tax rates by holding investments for more than a year.

- Invest in Tax-Efficient Funds: Choose funds with low turnover rates, like index funds and ETFs, which generate fewer taxable events.

For example, contributing to a Roth IRA allows your investments to grow tax-free, and qualified withdrawals in retirement are also tax-free. This strategy can significantly reduce your tax burden over the long term.

7. Investing for Dummies: Avoiding Common Mistakes

Investing can be intimidating, especially for beginners. Understanding common mistakes and how to avoid them can set you up for success. One of the biggest pitfalls is emotional investing.

7.1 Emotional Investing

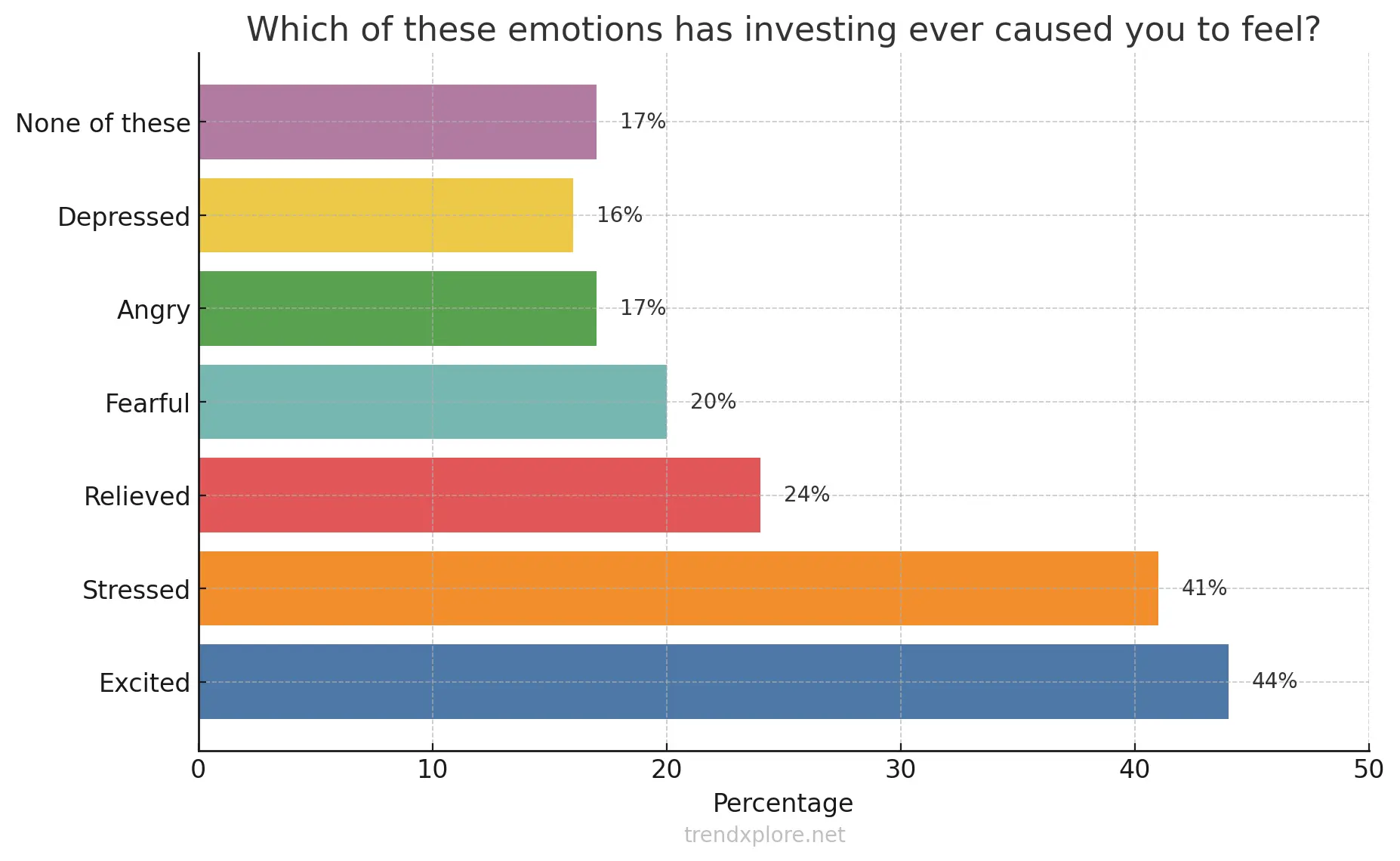

According to MagnifyMoney, 44% of investors feel excited about investing, making it the most common emotion. While stress is close behind, with 41% of investors experiencing tension as they begin, most report feeling relieved rather than fearful overall. In investing for dummies, emotions can be challenging to deal with.

Impact of Emotions on Investment Decisions

Emotions can greatly impact your investment decisions, often leading to poor outcomes. Here’s how:

- Fear: Fear can cause you to sell investments during a market downturn, locking in losses instead of waiting for a potential recovery. For example, during a stock market crash, panicking and selling your stocks could result in significant losses.

- Greed: Greed can push you to invest in high-risk assets with the hope of quick profits. This can lead to poor decisions, like buying into speculative stocks or bubbles. For instance, buying a stock just because it’s soaring in price without understanding its fundamentals can be risky.

- Overconfidence: Overconfidence can make you believe you can predict market movements. This might lead to frequent trading and trying to time the market, which often results in losses. For example, thinking you can consistently buy low and sell high is a common mistake among novice investors.

Tips to Avoid Emotional Investing

To avoid the pitfalls of emotional investing, follow these tips:

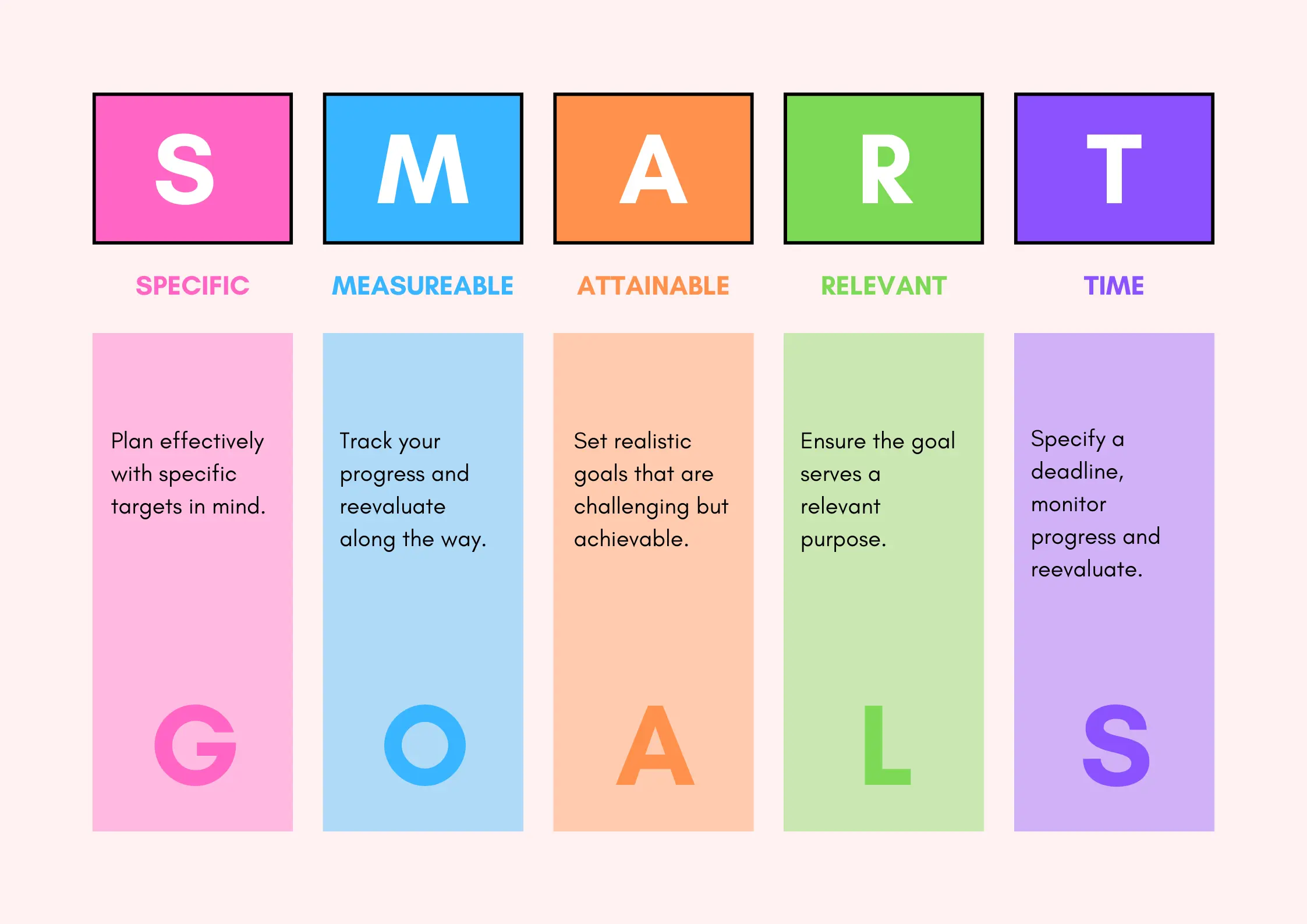

- Set Clear Goals: Define your investment goals and stick to them.

- Create a Plan: Develop an investment plan based on your risk tolerance, time horizon, and goals. A solid plan can guide your decisions and keep you on track during market volatility.

- Automate Investments: Use automatic investment plans to remove emotions from the equation. For example, set up automatic monthly transfers to your investment account. This ensures consistent investing regardless of market conditions.

- Stay Informed: Educate yourself about investing. The more you know, the less likely you are to make impulsive decisions. Read books, follow reliable blogs, and listen to investment podcasts.

- Diversify: Diversify your portfolio to spread risk. By investing in a mix of assets, you can reduce the impact of market swings on your overall portfolio.

- Limit News Consumption: Constantly checking financial news can lead to anxiety and impulsive decisions. Limit your news consumption to avoid reacting to short-term market movements.

- Stay Calm During Volatility: Market downturns are normal. Instead of panicking, remember that markets generally recover over time. Stay calm and stick to your long-term plan.

- Use a Financial Advisor or Robo-Advisor: Professionals can provide objective advice and help you make informed decisions. They can offer guidance based on your individual situation, reducing the influence of emotions.

For example, if the market drops and you feel the urge to sell your investments out of fear, refer back to your investment plan and goals. Remember that you are investing for the long term, and short-term market fluctuations are part of the journey.

7.2 Investing for Dummies: Market Timing

Why Market Timing is Often a Bad Idea

Market timing involves trying to predict the future movements of the market to buy low and sell high. While it sounds appealing, it’s extremely difficult to do consistently. Here’s why market timing is often a bad idea:

- Unpredictability: Markets are influenced by countless factors, including economic data, geopolitical events, and investor sentiment. Predicting these movements accurately is nearly impossible. For example, unexpected events like the COVID-19 pandemic can cause sudden market drops that no one predicted.

- Missing Out on Gains: If you try to time the market and sell during a downturn, you might miss the market’s best days. Missing even a few of these days can significantly impact your returns. For instance, if you were out of the market during a sudden rally, you’d lose out on those gains.

- Increased Costs: Frequent buying and selling can lead to higher transaction costs and taxes, which can eat into your returns. For example, short-term capital gains are taxed at a higher rate than long-term gains, reducing your overall profit.

Alternative Strategies to Market Timing

Instead of trying to time the market, consider these alternative strategies:

- Buy and Hold: This strategy involves buying investments and holding them for the long term, regardless of market fluctuations. It allows you to benefit from the overall growth of the market over time. For example, if you had bought and held an S&P 500 index fund for the past 20 years, you would have seen substantial growth despite short-term volatility.

- Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of the market’s performance. This approach reduces the impact of market volatility and lowers the average cost per share over time. For example, investing $100 every month in a mutual fund spreads your investment across different market conditions.

- Diversification: Spread your investments across various asset classes to reduce risk. Diversification ensures that poor performance in one area doesn’t drag down your entire portfolio.

7.3 Investing for Dummies: Lack of Diversification

Not diversifying your portfolio means putting all your money into a few investments. This increases your risk significantly. Here are some risks associated with lack of diversification:

- Concentration Risk: If a large portion of your portfolio is invested in one stock or sector, your entire portfolio is at risk if that investment performs poorly. For example, if you invest only in tech stocks and the tech sector crashes, your portfolio could suffer significant losses.

- Volatility: A non-diversified portfolio can experience more significant fluctuations in value. Diversification smooths out these ups and downs, providing more stable returns.

- Missed Opportunities: By focusing on a few investments, you might miss out on gains in other areas. For example, while tech stocks might be performing well, other sectors like healthcare or consumer goods could also offer substantial returns.

How to Ensure Your Portfolio is Well-Diversified

When it comes to investing for dummies, to ensure your portfolio is well-diversified, follow these steps:

- Spread Across Asset Classes: Invest in a mix of stocks, bonds, real estate, and commodities. This reduces the impact of any one asset class performing poorly.

- Invest in Different Sectors: Within your stock investments, diversify across various sectors like technology, healthcare, finance, and consumer goods. For example, include companies from different industries to spread risk.

- Geographic Diversification: Invest in both domestic and international markets. This spreads your risk across different economies and reduces the impact of a downturn in any one region. For example, consider adding international ETFs or mutual funds to your portfolio.

- Use Mutual Funds and ETFs: These funds offer instant diversification by holding a variety of assets. For example, an S&P 500 index fund invests in 500 different companies, providing broad market exposure.

- Regularly Review and Rebalance: Periodically review your portfolio to ensure it remains diversified. Rebalance as needed to maintain your desired asset allocation. For example, if one sector grows faster and now makes up a larger portion of your portfolio, sell some of those investments and buy others to restore balance.

8. Advanced Tips for Investing for Dummies

As you become more comfortable with investing, you can start exploring advanced strategies to enhance your returns. One of the most powerful concepts to understand is compound interest.

8.1 Compound Interest and Its Power

Explanation of Compound Interest

Compound interest is the process of earning interest on both your initial investment (the principal) and the interest that accumulates over time. It’s like a snowball effect, where your investment grows faster as time goes on.

To illustrate, let’s say you invest $1,000 at an annual interest rate of 5%. After the first year, you earn $50 in interest, making your total $1,050. In the second year, you earn interest on $1,050, not just your original $1,000. This means you earn $52.50 in interest, bringing your total to $1,102.50. Over time, this effect compounds, leading to significant growth.

How to Maximize Compound Interest in Your Investments

To take full advantage of compound interest, follow these strategies:

- Start Early: The earlier you start investing, the more time your money has to grow. Even small amounts invested early can grow substantially over time.

- Invest Regularly: Consistent contributions help build your investment and benefit from compound interest. Setting up automatic transfers to your investment account ensures you invest regularly without having to think about it. For example, contributing to a 401(k) or an IRA monthly allows your investments to grow steadily.

- Reinvest Earnings: Make sure to reinvest dividends and interest back into your investments. This accelerates the compounding effect. For instance, if you receive dividends from stocks or interest from bonds, reinvest them rather than taking them out as cash.

- Choose High-Interest Investments: While higher returns often come with higher risks, choosing investments with good returns can significantly boost your compound interest. For example, stocks and mutual funds typically offer higher returns than savings accounts or CDs over the long term.

- Be Patient: Compounding takes time to show significant effects. Avoid the temptation to withdraw your investments prematurely. Letting your money stay invested allows the compounding effect to work its magic.

- Utilize Tax-Advantaged Accounts: Accounts like Roth IRAs and 401(k)s allow your investments to grow tax-free or tax-deferred, enhancing the compounding effect.

For example, if you invest $10,000 in a retirement account at an average annual return of 7% and let it grow for 30 years without adding any more money, it could grow to over $76,000 due to compound interest. If you add $100 a month to this account, the amount could grow to over $180,000.

8.2 Leverage and Margin Trading

What is Leverage and How to Use It

Leverage involves using borrowed money to increase the potential return of an investment. By borrowing funds, you can buy more of an investment than you could with your own money alone. This amplifies both gains and losses.

For example, if you have $1,000 and use leverage to borrow an additional $1,000, you now have $2,000 to invest. If your investment grows by 10%, you earn $200 instead of $100. However, if it loses 10%, you lose $200, not just $100.

Risks Associated With Margin Trading

Margin trading is a common way to use leverage. It involves borrowing money from your broker to buy securities. While margin trading can amplify gains, it also significantly increases risk. Here are some key risks:

- Increased Losses: Just as leverage can amplify gains, it can also amplify losses. If your investments decline in value, you must still repay the borrowed funds, which can lead to larger losses than you could afford.

- Margin Calls: If the value of your account falls below a certain level, your broker may issue a margin call, requiring you to deposit more money or sell some assets to cover the loan. For example, if you borrow $1,000 on margin and your investment drops significantly, you may need to quickly find additional funds to avoid forced sales.

- Interest Costs: Borrowing money on margin incurs interest, which can add up over time and reduce your overall returns. For instance, if the interest rate on your margin loan is 8%, you must earn more than 8% on your investments just to break even.

8.3 Retirement Accounts

Overview of Different Retirement Accounts

Planning for retirement is a critical aspect of investing for dummies. Understanding the various retirement accounts available can help you choose the best one for your needs.

- Traditional IRA: Contributions to a traditional IRA are often tax-deductible, and the investments grow tax-deferred until you withdraw them in retirement. For example, if you contribute $6,000 a year, you can deduct that amount from your taxable income, reducing your tax bill.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, so they are not tax-deductible. However, the investments grow tax-free, and withdrawals in retirement are also tax-free. For instance, if you invest $5,000 in a Roth IRA and it grows to $20,000, you can withdraw the $20,000 tax-free in retirement.

- 401(k): Offered by many employers, a 401(k) allows you to contribute a portion of your salary to a retirement account. Contributions are pre-tax, reducing your taxable income. Many employers offer matching contributions, which are essentially free money for your retirement. For example, if your employer matches 50% of your contributions up to 6% of your salary, you should contribute at least 6% to get the full match.

- Roth 401(k): Similar to a traditional 401(k), contributions are made with after-tax dollars, and withdrawals in retirement are tax-free. This combines features of both a traditional 401(k) and a Roth IRA.

How to choose the right retirement account for you

Choosing the right retirement account depends on several factors, including your current financial situation, tax considerations, and retirement goals. Here’s how to decide:

- Tax Considerations: If you expect to be in a lower tax bracket in retirement, a traditional IRA or 401(k) might be better because of the immediate tax deduction. If you expect to be in a higher tax bracket, a Roth IRA or Roth 401(k) might be better because withdrawals are tax-free.

- Employer Match: If your employer offers a matching contribution for a 401(k), prioritize contributing enough to get the full match. This is free money that significantly boosts your retirement savings.

- Flexibility and Control: IRAs typically offer more investment options than 401(k)s, giving you greater control over your investments. If you prefer more investment choices, an IRA might be suitable.

- Income Limits: Roth IRAs have income limits that restrict high earners from contributing. Check if you are eligible based on your income.

For example, if you are young and expect your income and tax rate to increase in the future, contributing to a Roth IRA could be advantageous. If you have an employer who offers a 401(k) match, prioritize that to maximize your savings.

Investing for Dummies – Final Words

So far, we have ticked all boxes concerning “investing for dummies”. Investing doesn’t need to be overwhelming. By following the simple steps in this guide, you can confidently take charge of your financial future. The secret to successful investing is starting early, staying informed, and maintaining consistency.

Whether you’re planning for retirement, saving for a major purchase, or aiming to build wealth, investing is a powerful strategy. By now, you should feel more confident and ready to begin your investing journey.

How do you plan to start? Share your thoughts in the comments below!

Recommended:

FAQs About Investing for Dummies

Q: What is the best way to start investing for beginners?

A: In demystifying “investing for dummies”, the best way to start investing for beginners is to educate yourself, set clear financial goals, and begin with a simple investment strategy. Start with low-cost index funds or ETFs, which offer diversification and are easier to manage.

Q: How much money do I need to start investing?

A: You don’t need a lot of money to start investing. Many investment platforms allow you to start with as little as $100. The key is to start early and invest regularly, even if the amount is small.

Q: What is the difference between saving and investing?

A: Saving is setting aside money for future use, usually in a low-risk account like a savings account. Investing involves putting money into assets like stocks, bonds, or real estate, with the goal of earning a return over time. Investing carries more risk but also offers the potential for higher returns.

Q: Is investing risky?

A: All investments carry some level of risk, but not investing also has risks, like not keeping up with inflation. Understanding your risk tolerance and diversifying your investments can help manage these risks.

Q: How do I know which investments are right for me?

A: The right investments depend on your financial goals, risk tolerance, and time horizon. Research different types of investments, and consider speaking with a financial advisor to tailor an investment strategy that fits your needs.

Q: Can I lose all my money in the stock market?

A: While it is possible to lose money in the stock market, you can reduce this risk by diversifying your investments and investing for the long term. It’s also important to avoid making emotional decisions based on short-term market fluctuations.

Q: What are the benefits of using a financial advisor?

A: A financial advisor can provide personalized advice, help you develop an investment strategy, and keep you on track with your financial goals. They can also offer insights into complex financial matters and assist with long-term planning.

Q: How often should I review my investment portfolio?

A: In our “investing for dummies” journey, we established that you should review your investment portfolio at least once a year or whenever there are significant changes in your financial situation or goals. Regular reviews help ensure your investments remain aligned with your objectives.

Q: What is dollar-cost averaging?

A: Dollar-cost averaging is an investment strategy where you invest a fixed amount of money at regular intervals, regardless of the market conditions. This approach can help reduce the impact of market volatility and lower the average cost of your investments over time.

Q: What are the tax implications of investing?

A: Different investments have different tax implications. For example, dividends, capital gains, and interest income may be taxed differently. It’s important to understand these implications and consider tax-efficient investment strategies to minimize your tax liability. An this is all we have in our “investing for dummies” journey.